Binance and its lawyers filed a motion to dismiss the recently amended complaint submitted by the US SEC in its lawsuit against the crypto exchange.

Although the SEC amended its complaint last month, it still insists that almost all transactions involving cryptocurrencies are securities transactions.

The latest filing asserts that the SEC refused to provide specific standards for determining which cryptocurrency transactions qualify as investment contracts.

Binance’s Motion to Dismiss SEC Complaint

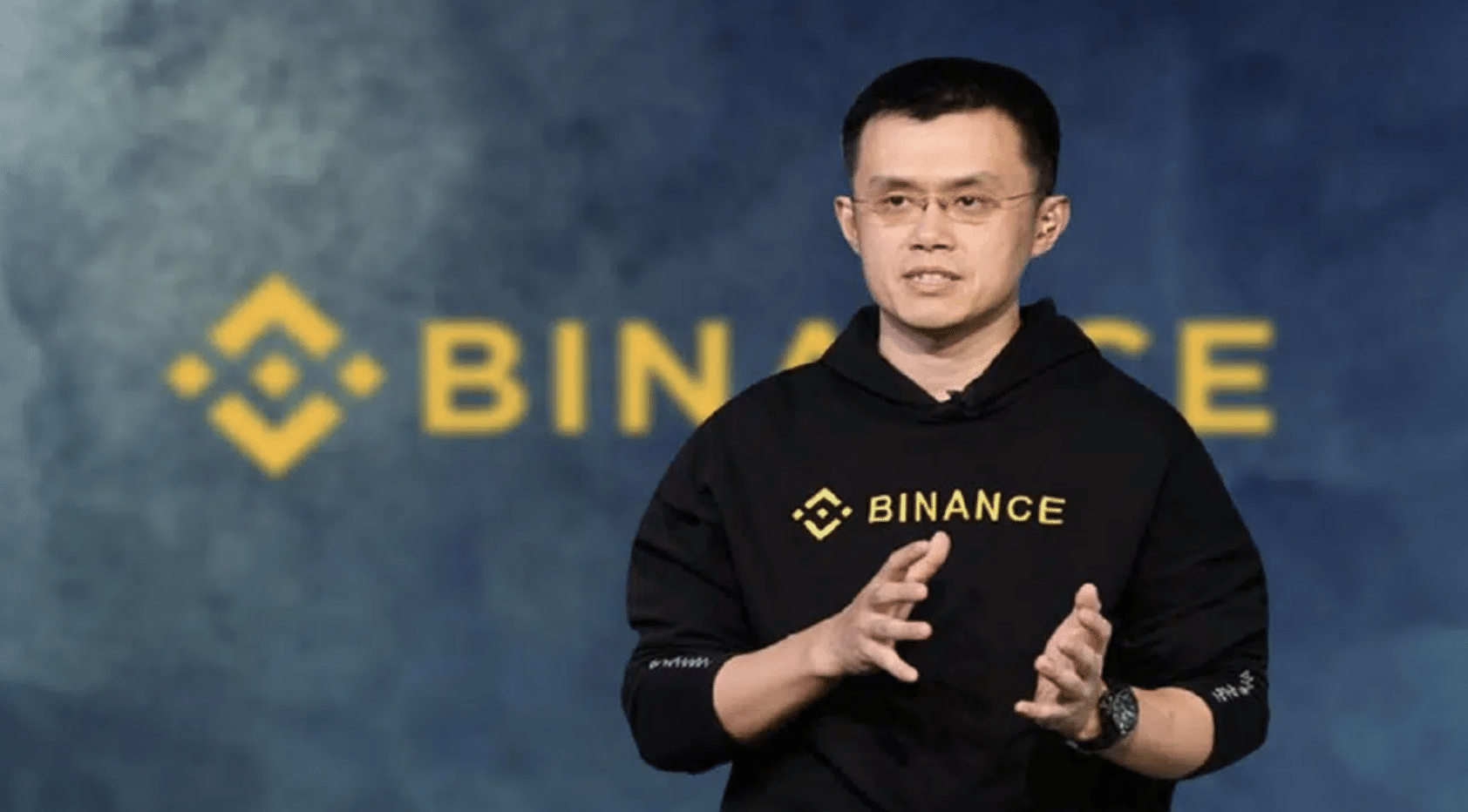

Lawyers representing Binance and its former CEO Changpeng Zhao (CZ) have made another attempt to toss the SEC lawsuit. On November 4, they filed a motion to dismiss the SEC’s newly amended complaint.

Following a June 4 ruling that the SEC failed to establish that crypto assets were securities, the regulator sought to amend its complaint against Binance.

In its filing, the commission sought to amend its initial complaint where it used the phrase “crypto asset securities.” The SEC said its use of the phrase does not necessarily mean it refers to the crypto asset in itself as a security.

The regulator said it regrets any confusion its use of the phrase may have caused. According to the SEC’s explanation, the crypto assets mentioned in the Binance lawsuit were sold via a scheme involving unregistered investment contracts.

However, this amendment further confused crypto community members, with many apprehensive about the SEC’s position on crypto assets.

In response, Binance’s defense team slammed the regulator in its latest motion. The motion argues that the amended complaint does not respect an earlier court ruling that crypto assets themselves are not securities.

It noted that the SEC refused to accept the ruling’s logical conclusion that secondary market resales of crypto assets after distribution by the developers are not securities transactions.

Instead, the SEC insists that virtually all crypto asset transactions, including secondary market token resales, are securities transactions. Furthermore, the filing slammed the SEC for failing to establish clear regulations regarding virtual assets.

Part of the filing reads: “The SEC still refuses to articulate any standard for courts, litigations, or market participants to know which crypto-asset transactions qualify as investment contracts.”

Further, it accused the commission of arbitrarily choosing winners and losers. It cited the SEC’s recent abandonment of its claim that Ethereum transactions are investment contracts as an example.

SEC Case Against Binance and Its Founder and Former CEO CZ

In June last year, the US Securities and Exchange Commission filed a lawsuit against Changpeng Zhao and three associated companies. These include BAM Trading Service, BAM Management US Holdings, and Binance Holdings.

The securities regulator accused Binance of operating an unlicensed brokerage service and offering unregistered securities. It stated that transactions involving over a dozen crypto assets listed on the crypto exchange were investment contracts.

This case is independent of the Department of Justice (DOJ) charges against Binance Holdings and Zhao. The DOJ charged the crypto exchange and its former CEO with operating an unlicensed money-transmitting business and violating anti-money laundering and sanctions.

This matter was resolved last November after the exchange pleaded guilty to the charges and agreed to pay a $4 billion fine. Meanwhile, CZ also stepped down as CEO after admitting to committing the crimes.

Add TechReport to Your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

Rida is a dedicated crypto journalist with a passion for the latest developments in the cryptocurrency world. With a keen eye for detail and a commitment to thorough research, she delivers timely and insightful news articles that keep her readers informed about the rapidly evolving digital economy.

View all articles by Rida Fatima

The Tech Report editorial policy is centered on providing helpful, accurate content that offers real value to our readers. We only work with experienced writers who have specific knowledge in the topics they cover, including latest developments in technology, online privacy, cryptocurrencies, software, and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards, and every article is 100% written by real authors.