This is an opinion editorial by Federico Rivi, an independent journalist and author of the Bitcoin Train newsletter.

We are raising interest rates “because we are fighting inflation. Inflation has come out of practically nothing.” So said European Central Bank President Christine Lagarde, on the Irish talk show Late Late Show on October 28, 2022. Words apparently contradicting a statement that came shortly afterwards in the same interview. Inflation, she said, is caused “by Russian President Vladimir Putin’s war in Ukraine. […] This energy crisis is causing massive inflation that we have to defeat.”

The Rate Hike

The day before the interview the European Central Bank had raised interest rates by a further 75 basis points, bringing the total growth applied in the last three meetings to 2%: the highest level since 2009. In all likelihood it will not end there, as the Governing Council plans to “raise rates further to ensure a timely return of inflation to its medium-term objective of 2 per cent.”

According to the latest data, the rise in prices in the euro area has actually reached levels never seen in the last 20 years: +9.9% in September compared to the same month last year. Countries like Latvia, Lithuania and Estonia are seeing price increases of 22%, 22.5% and 24.1% respectively.

In the widespread consensus on the meaning of the term inflation, however, there is a major inconsistency. A distortion of the real concept that leads leaders, experts – and consequently the media – to attribute different causes to the word, depending on the convenience of the moment. When the cause, in reality, is always and only one.

Inflation And Price Increases Are Different

For many, inflation is now synonymous with rising prices. This is not just a widespread belief but a meaning that has also been adopted by economics textbooks and the official language. According to Cambridge Dictionary inflation is “a general, continuous increase in prices.”

But is this really the case? Bitcoin teaches one thing: Don’t trust, verify. And by verifying, a problem emerges: the reversal of cause and effect.

Inflation is treated as the effect of a certain event: an energy crisis, a chip shortage, a drought can all lead to higher prices for goods and services in certain sectors. But in reality inflation, in its original meaning, does not mean the rise in prices, it indicates its cause.

The clue comes directly from etymology: inflation comes from the Latin word inflatio, itself a derivative of inflare, i.e. to inflate. Think about inflating a balloon: the act of inflare (inflating) is when air is blown from the mouth into the balloon: the cause. The immediate consequence is the expansion of the volume of the balloon that is taking in air: the effect.

Pumping new air into the balloon is the action that leads to its expansion. The same reasoning applies to money: the very act of printing money is inflation and its consequence is an increase in prices. This reversal of cause and effect was already referred to in the late 1950s as semantic confusion by one of the most prominent economists of the Austrian school, Ludwig von Mises:

“There is nowadays a very reprehensible, even dangerous, semantic confusion that makes it extremely difficult for the non-expert to grasp the true state of affairs. Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term “inflation” to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages.”

If, therefore, there can be many causes of price increases, there cannot be as many causes of inflation because it is itself an origin of price increases. It would be much more adequate and intellectually honest to say that the decrease in purchasing power can result from several factors including inflation, i.e. the printing of money.

Money Flooding

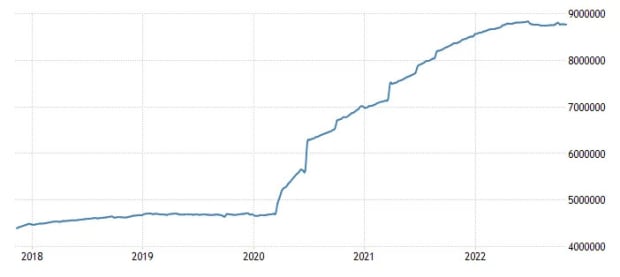

So how has the European Central Bank behaved in terms of monetary issuance in recent years? The most effective figure to understand this is the ECB balance sheet, which shows the countervalue of assets held: those assets for which the Eurotower does not pay but acquires by creating new currency. As of October 2022, the ECB held almost EUR 9 trillion. Before the pandemic, at the beginning of 2019, it had around EUR 4.75 trillion. Frankfurt has almost doubled its money supply in three and a half years.

Euro Area Central Bank Balance Sheet. Source: Trading Economics

If we measure the amount of euros circulating in the form of banknotes and deposits – the figure defined as M1 – the number is slightly more reassuring, but not much: at the beginning of 2019 there were almost EUR 8.5 trillion in circulation, today there are 11.7 trillion. A growth of 37.6%.

Euro Area Money Supply M1. Source: Trading Economics

Are we really sure, then, that this price growth – or as it is wrongly called by everyone, inflation – comes from nowhere? Or that it is just a consequence of the war in Ukraine? Given the amount of money supply injected into the market in the last three years, we should count ourselves lucky that the average price growth of goods and services is still stuck at 10%, due to the restrictions of the pandemic and the subsequent economic crisis we are entering.

What does Bitcoin have to do with all this? Bitcoin has everything to do with it because it was born as an alternative to the economic catastrophes for which central banks continue to make themselves responsible. An alternative to the bubbles of unsustainable growth alternating with ruinous crises caused by the market manipulation of the interventionist utopia. Bitcoin cannot tell the world that “inflation came from nowhere,” because its code is public and everyone can check its monetary policy. A policy that does not change and cannot be manipulated. It is fixed and will remain so. 2.1 quadrillion satoshis. Not one more.

This is a guest post by Federico Rivi. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.